VA home loans offer one of the most powerful paths to buying a home: no down payment, no private mortgage insurance, and competitive interest rates that can save you thousands over the life of your loan.

At Veterans for Veterans, we connect you with VA-approved lenders who work with active-duty service members and veterans every day. They understand the VA loan process inside and out, which means fewer delays, smoother closings, and a home purchase experience that actually works for you.

VA loans are designed specifically to make homeownership more accessible for those who’ve served.

While conventional loans often require 5-20% down, qualified veterans can purchase a home with zero money down. That means you can stop waiting and start owning.

Most lenders require PMI if you put down less than 20%, adding hundreds to your monthly payment. VA loans eliminate this requirement entirely, keeping more money in your pocket each month.

VA loans typically offer lower interest rates than conventional mortgages. Over a 30-year loan, this can translate to tens of thousands in savings.

Your credit score doesn't have to be perfect. VA loans offer more lenient requirements than conventional mortgages, opening the door for veterans who might not qualify elsewhere.

Sellers can contribute up to 4% of the home's value toward your closing costs, reducing what you need to bring to the table.

Veterans for Veterans offers guidance across three core VA loan paths. Whether you’re buying your first home, upgrading, or looking to refinance, we’ll match you with lenders who specialize in serving veterans.

Buying a home should feel like a milestone, not a marathon. We help first-time and repeat buyers navigate the VA loan process with confidence. Our network of VA approved lenders understands the unique requirements of VA financing and will guide you from pre-approval through closing day.

What you can expect:

Already have a VA loan? The IRRRL (also called a VA Streamline Refinance) helps you lower your interest rate and reduce your monthly payment with minimal paperwork. It's one of the fastest, simplest refinance options available.

Best for veterans who want to:

Your home equity is a financial tool. A VA Cash-Out Refinance lets you tap into that equity to consolidate debt, fund home improvements, or cover major expenses, all while potentially securing a better rate.

Best for veterans who want to:

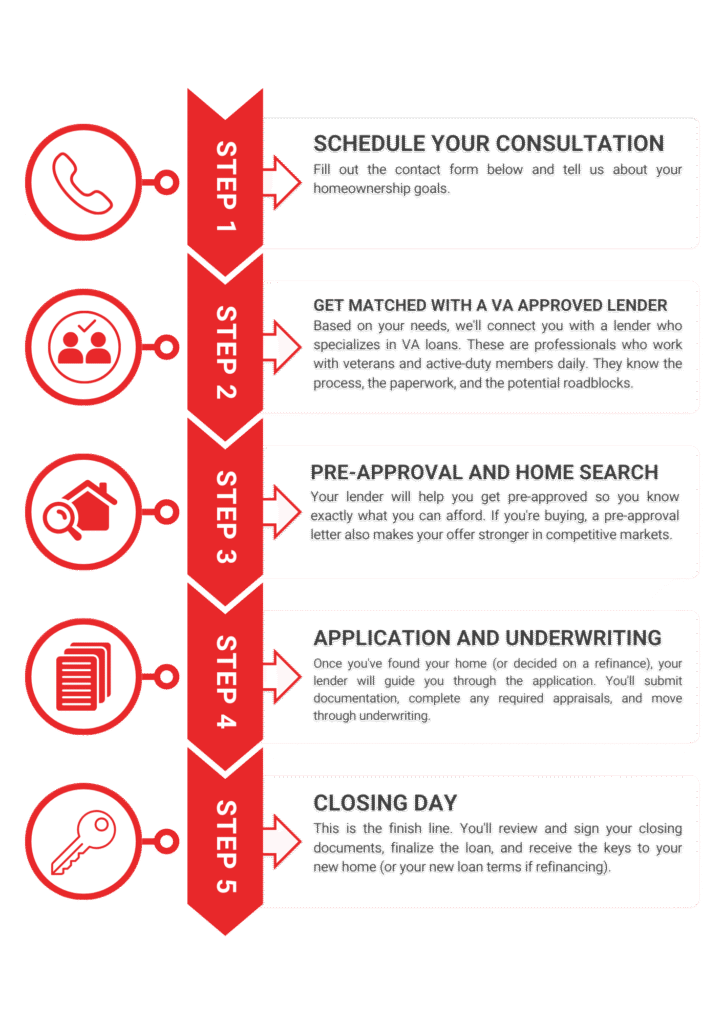

Working with Veterans for Veterans is straightforward. Here’s what to expect:

Fill out the contact form below and tell us about your homeownership goals.

Most lenders require PMI if you put down less than 20%, adding hundreds to your monthly payment. VA loans eliminate this requirement entirely, keeping more money in your pocket each month.

Your lender will help you get pre-approved so you know exactly what you can afford. If you're buying, a pre-approval letter also makes your offer stronger in competitive markets.

Once you've found your home (or decided on a refinance), your lender will guide you through the application. You'll submit documentation, complete any required appraisals, and move through underwriting.

This is the finish line. You'll review and sign your closing documents, finalize the loan, and receive the keys to your new home (or your new loan terms if refinancing).

Throughout this process, you’re never alone. Our team and your lender work together to keep things moving smoothly and answer questions as they come up.

You’ve earned access to one of the best mortgage programs available. Let’s make sure you use it. Fill out the form below to schedule your consultation. We’ll discuss your goals, answer your questions, and connect you with a VA-approved lender who can help you move forward.

Veterans across the country have trusted V4V to help them secure the benefits they earned. Here’s what they have to say: